Banking on the platform economy — Singapore point of view

What’s past is prologue

Once a change-less bastion, financial services are experiencing a rapid and dramatic evolution. The COVID pandemic has added further impetus to the rate and pace of change. Banking is being mixed in with services or products from other areas and industries — from healthcare and telephony, to mobility and media, retail and logistics, and numerous other areas. Banking is becoming embedded — sometimes almost invisibly — in non-bank business processes. New types of ecosystems are emerging, powered by dynamic new business models, often based around platforms and network economics.

New business imperatives are emerging. Customers are being engaged in innovative ways — and by different parties. Telephony businesses are becoming a channel through which customers can engage in healthcare discussions. Retailers are orchestrating payments systems. And social media businesses are establishing new forms of currency.

Organizations in virtually every sector seem to be contesting the relationship with customers, hoping to become not only the provider of their own products, but also an entry point for other businesses seeking access to their primary customers. Forward-thinking organizations look to become curators of experiences as well as of specific products and services. And this cross-pollination of customer access is based on insights gained from robust data.

Organizations are looking to maintain a primary relationship with their customers — to avoid being disintermediated by insurgents from both their own and completely different industries. But the playing field for deep customer engagement is not a level one. Unlike aspirationals from other industries — and perhaps counterintuitively — banks are uniquely positioned for success in becoming the prime entity for building and maintaining relationships with customers.

Banks possess a key advantage that most organizations don’t have. Our research suggests that people are willing to share their personal data with their banks, and banks are trusted to keep the data safe and use it ethically, even if they are mandated to do so by regulators.

A Singaporean perspective

According to a recent IBM Institute for Business Value (IBV) survey conducted in collaboration with Survey Monkey, 87 percent of Singaporean survey respondents trust their bank or other financial institution to protect their personal information and data to at least a moderate extent.

Indeed, IBV research indicates that 57 percent of Singapore’s citizens and consumers trust their bank more than any other organization or institution they interact with except the government (cited by 67 percent). They reported the same level of trust, 57 percent, with their employer.

The emerging ecosystem environment impacts banks and banking, as well as the highly systemic position banks hold compared to other institutions in the economy. As a “trusted partner,” banks have a unique opportunity to become a conduit — or curator — of products, services, and experiences to fulfill broad underlying aspirations of their customers, rather than merely the financial ones.

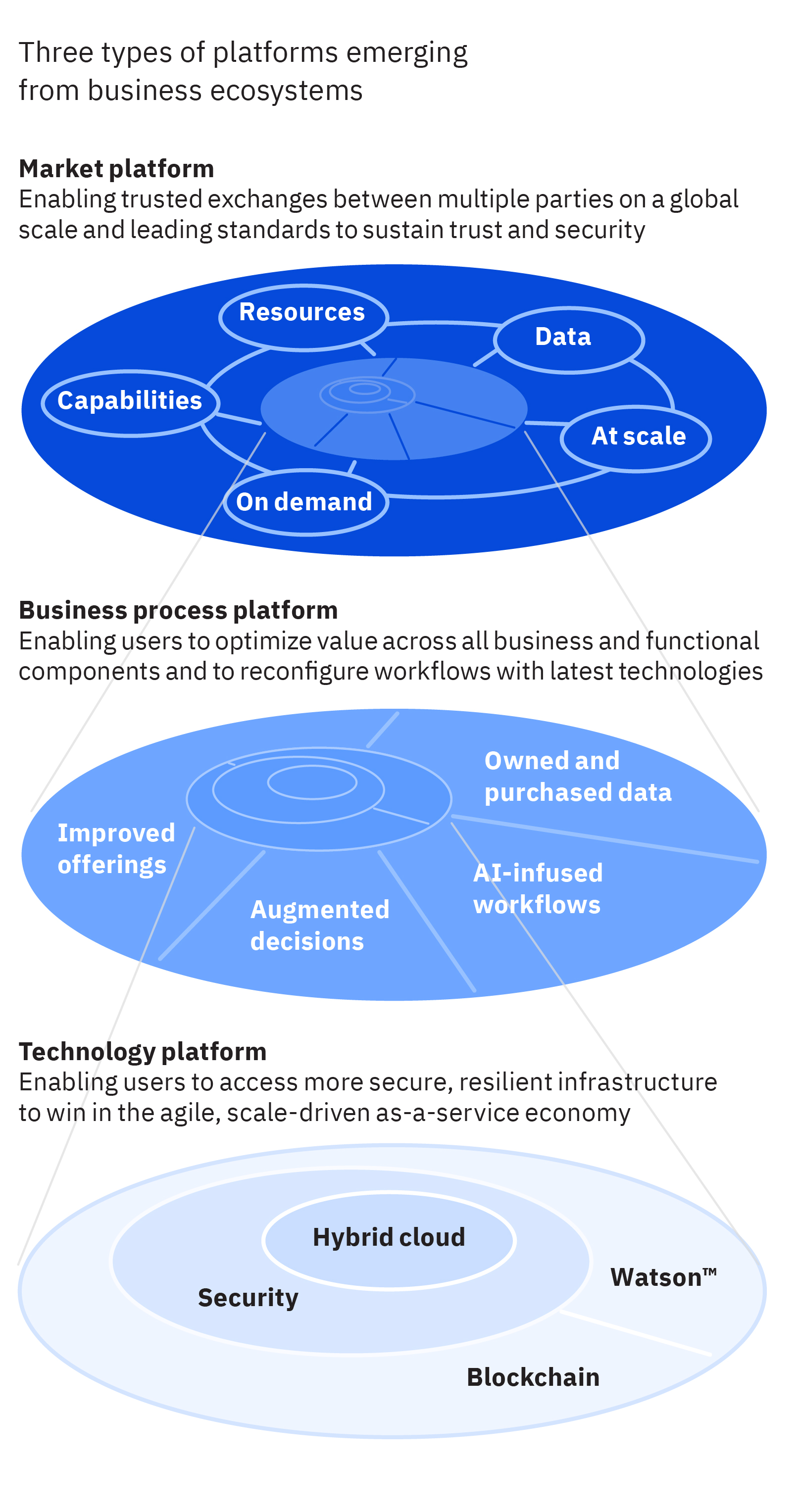

A bank might, for example, build or participate in platforms or ecosystems that enable its customer to become more successful, with those platforms taking on several different forms (see figure). Instead of limiting itself to transactions, a bank might collaborate on behalf of its customer to source a range of necessary or helpful inputs and to coordinate specialized capabilities.

The visionary bank

Visionary banks are building inclusive, flexible ecosystems of financial and other capabilities. Participants in deeper, more sophisticated ecosystems might come from any area of the economy, their commonality being the contribution of useful or necessary business functions and technical capabilities that create value. Ecosystem providers and consumers meet on business platforms — digital or, at times, physical structures — through which interactions, including communications, collaborations, and transactions, occur.

Radical transformation is required across business and operating models and in the way resources, business processes, and technologies are assembled to create value. How can banks reorganize the way they do business to compete successfully in an age of new cross-industry platform business models? Our report concludes with a six-step action guide that should help simplify the process significantly.

Meet the authors

Arun Biswas, Managing Partner, Strategic Sales and Sustainability Consulting, APAC, IBM ConsultingNitin Sharma, Associate Partner, Financial Services Sector, IBM Singapore

Likhit Wagle, General Manager, IBM Global Banking Industry

Anthony Marshall, Senior Research Director, Thought Leadership, IBM Institute for Business Value

Originally published 14 July 2020