A leading European/UK bank increased its customer satisfaction around automated, multichannel services to a Net Promoter Score (NPS) of 70 and rolled out new automated multichannel customer processes 88 percent faster by using an efficient process management capability that taps IBM Business Automation Workflow.

The COVID-19 pandemic continues to have a significant impact on the world’s population, industries and entire economies. Our lives have changed, in every country, in every way, and amidst ongoing uncertainty.

The action and reaction of our European Banks will be the beating heart of ensuring stability and driving economic recovery in Europe. Successful post-pandemic banks will be those that understand the essentials to providing certainty in an uncertain world.

Impact on the European economy

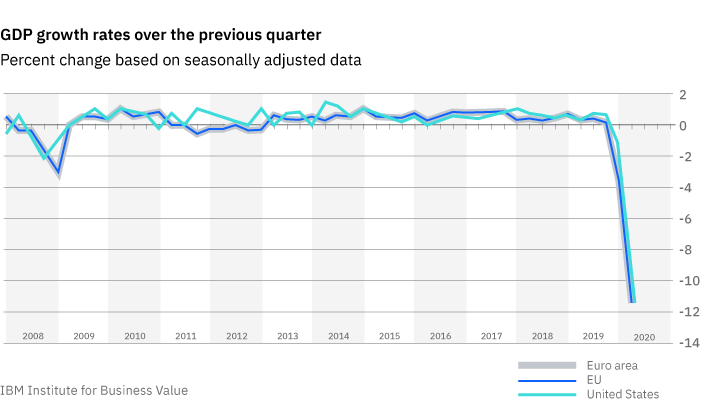

The overall impact on the economy in Europe has been profound. Eurostat reported a decrease of GDP in the euro area of 12.1 percent in the second quarter of 2020, versus the previous quarter. This is the biggest fall in GDP since 1995. In the first quarter, GDP fell by 3.6 percent in the euro area. Compared with the second quarter of 2019, the drop is even greater—15.0 percent.

The dramatic second quarter GDP drop is observable across the world, which comes as no surprise. The impact in the United States is dramatic as well, although slightly less so than in Europe. US GDP decreased in second quarter by 9.5 percent versus the previous quarter.

The consequences for European banks

As outlined in the IBV Expert Insights report "Essentials for the post-pandemic bank", credit defaults have escalated on a global scale. Higher levels of non-performing-loans (NPL) are triggered in retail banking by high unemployment rates, high delinquencies in credit card operations and unsecured loans. In wholesale banking, small and medium enterprises default rates have risen and will expected to continue to rise. For large corporations, heavy restructuring is already seen in hard-hit industries, such as travel and transportation.

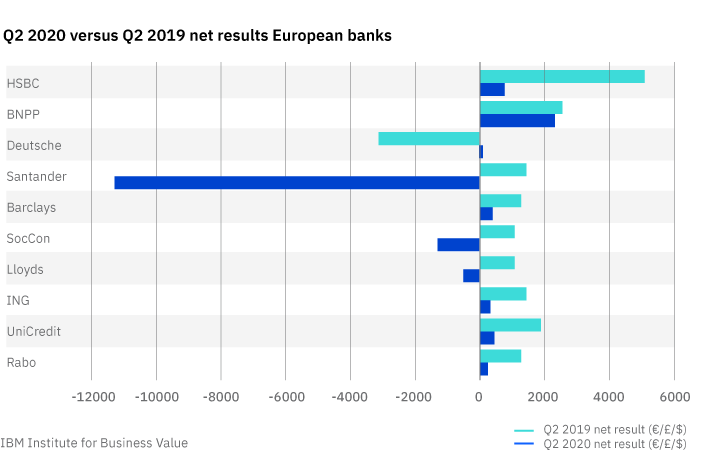

With 2020 second-quarter results recently reported by all European large banks, the overall picture is clear. Non trading-related profits have dramatically fallen, compared to second quarter of last year.

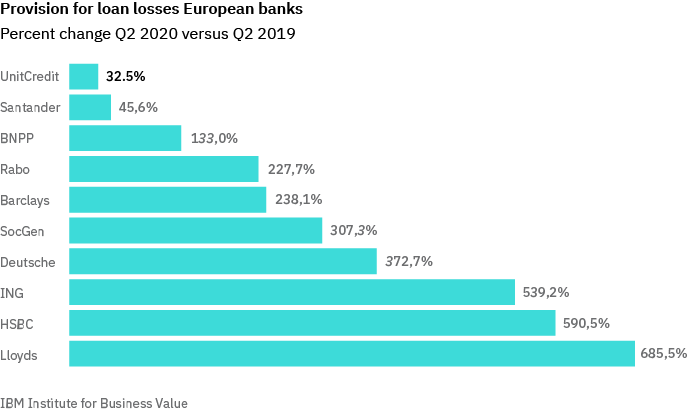

The dominant trigger clearly is the significant increase in the provision for bad loans in Q2 2020.

Four imperatives for the financial services industry in Europe

Lower cost structure radically

Given the financial impact on European banks, banks must operate at radically lower costs. Financial institutions will have to act quickly to cut more cost and uncover new savings and efficiencies.

The cost savings areas for financial services will need to be:

- Substantial: Cut greater than 40 percent to reflect new economic and competitive realities

- Structural: Be structural in nature, going beyond being capacity-reducing

- Sustainable: Deliver a sustainable cost structure without impacting customer, resiliency, compliance, and security requirements.

Adopt extreme digitization on cloud

Extreme digitization starts with evolving the customer experience to create more cohesive and personal digital journeys. This requires combining and integrating every aspect of customer experience into a single platform and tooling. Moving beyond the customer interface, digitization includes middle- and back-office operations. It also supports functions that can be transformed and automated into intelligent workflows.

One of the key approaches for banks to apply is intelligent automation. The ongoing digitization and automation of work, by infusing Robotics, AI and Machine Learning into business processes, will enable banks to operate at lower cost. The areas in which to apply intelligent automation range from loan processing, customer onboarding, risk and compliance, to learning and development. Extreme digitization is developed on an open hybrid cloud platform that enables financial institutions to securely build, run and manage apps and workloads in a consistent way, across any cloud. IBM is a recognized leader in this space and has helped financial institutions create efficiencies, improve customers outcomes and reduce risk.

A leading European/Dutch bank bank embarked on a learning transformation journey, aiming to close the skills gap of employees in critical areas such as digital customer engagement and KYC/AML, by providing personalized, 24/7 available e-learning. The platform had to meet very strict data regulations and requirements (C3). The closing of employee skills gaps led to better customer engagement and cost savings in learning for the bank, which were used to fund the ongoing HR transformation.

Reinvent customer engagements

Remote working and changes in digital consumption models are altering the routines and expectations of customers, especially in terms of their digital adoption and adaptation. In the post-COVID World the data-driven bank will be driven by the data-enabled client. Customer proximity will be fostered less by using data to personalize offers, and more by infusing every interaction with artificial intelligence (AI). This new business model brings new value by preserving client proximity and enabling compelling user experiences, particularly during crises such as the pandemic lockdown.

A leading UK bank takes on digital transformation to make home buying easier. While on the phone, with a customer, the bank employee gets fast digital mortgage support from Marge, an AI-powered, cloud-based platform with an evolving personality. With Cognitive enterprise technology at their fingertips, employees support new and existing home buying customers seeing 20 percent improvement in customer NPS, and a 10 percent decrease in call duration.

In times of crisis, a flight-to-quality or a flight-to-safety occurs when customers migrate to environments that are perceived to be less risky, even if they later prove to be otherwise. This can manifest itself as sudden and unexpected migration of clients due to a negative perception or single bad experience being amplified.

To ensure no client relationship relies on demand-outdated models, or that clients become “digitally left behind,” banks should preserve both the perception and reality of quality and safety for their customer experiences—and provide easy accessibility. Ensuring that distanced does not mean disadvantaged will be an essential part of economic recovery. Financial institutions that employ a human-centric model will help their customers navigate and thrive in an uncertain world.

Make everything secure and compliant to the core

Prior to the 2020 pandemic, the industry was already under pressure to ensure compliance to regulations, particularly in the space of AML and Data Protection.

Fenergo Global Research Report on Financial Institution Fines and Enforcement Actions:

COVID-19 has dramatically amplified both the speed and the need to ensure compliance, accelerating reliance on digital platforms, increasing interconnectivity, expanding channels and 24/7 access. Each of these enhancements brings innovation to the client experience but also drives an increase in novel and unanticipated security risks, threats, and potential for data breaches, fraud and money laundering.

Bad actors use uncertainty and chaos to conceal their activities. Risk mitigation depends on removing any obscuring layers by quickly exposing suspicious transactions, connections and patterns in data. It is essential to know your customer and how they behave so you can rapidly identify anomalies. Advanced analytics, Machine Learning and AI that, in turn, drive intelligent automation will be enable banks to move faster than the speed of the threat and while complying with increasingly complex regulations.

Consider this recent example undertaken by notable banking partners, including BNP Paribas, to deliver a public cloud platform that is Financial Services ready. It is designed to enable a rich public cloud ecosystem that supports customer proximity, with specific features for security, compliance and resiliency that financial institutions require.

A leading European bank works with IBM to develop a public cloud secure enough for Banking. Faced with changing consumer behaviors and expectations in areas such as real-time banking, mobile services and access to a more complete view of their financial situation, the project aims to accelerate the bank’s digital transformation and improve its operational efficiency whilst meeting the industry’s extreme regulatory requirements. For its French operation, the bank had to satisfy European Banking regulations, French disaster recovery rules and EU privacy laws.

Financial Services clients, particularly in Europe, require a policy framework that enables a collaborative model for implementing security control and compliance. This policy framework needs to support industry-informed cloud controls required to operate securely with bank-sensitive data in the public cloud. Common operational criteria and a streamlined compliance controls framework built specifically for the financial services industry allows the ecosystem to function with confidence.

The journey to a secure and successful next normal requires the courage to truly modernize the application portfolio. This includes migrating to resilient and secure clouds; driving the digitization of processes into intelligent workflows; building self-serve capabilities; embedding security and compliance across operations; and designing a new relationship with customers. The IBV has gathered a set of best practices and recommendations in our COVID-19 Action Guide, along with related resources to support you as you make the journey.