Innovation is critical to respond to industry challenges

The oil and gas industry, historically, has been fueled by innovation. Reflection seismography, which first revolutionized petroleum exploration in the 1920s, prompted oilfield discoveries worldwide and filled billions of barrels of oil. Fluid catalytic cracking, discovered in 1937, served to advance refining and still produces most of the world's gasoline. More recently, horizontal drilling and hydraulic fracturing—or “fracking”—led the commercial exploitation of massive, unconventional oil and gas resources that were once considered uneconomic.

As the industry faces continued pressure to streamline operations and reduce costs due to overcapitalization, budget overruns, and production oversupply, the IBM Institute for Business Value (IBV) and Oxford Economics surveyed 350 oil and gas executives in 25 countries involved in defining or executing their organization’s innovation strategy.

More stringent regulations on emissions and political uncertainty are increasing industry constraints because the next energy transition demands a fine balance among existing companies’ portfolios and investment in areas such as renewables, electricity, hydrogen, and biofuels. And with the young workforce perceiving oil and gas as an “out of favor” industry, employment has fallen precipitously in extraction (exploration and production) and support (oilfield services).

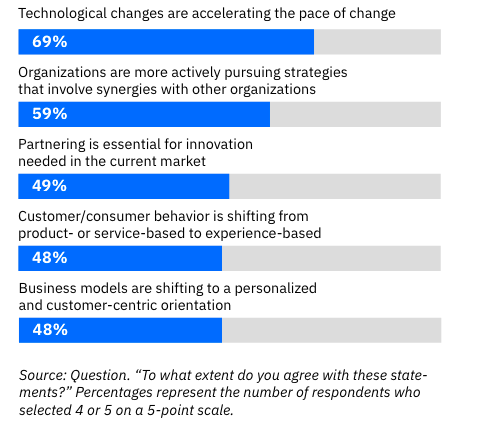

Compounding these challenges are market dynamics from the rapid pace of technology advances, increased customer demand, and the formation of a diverse startup ecosystem in the industry.

Market dynamics are shifting

The industry lags behind in the adoption of digital

Digital technologies allow oil and gas organizations to interconnect products, value chains, and business models. Analytics enables predictive maintenance, smart drilling, and smart oilfields to drive profitability on extracted barrels. Yet, the industry lags behind in the adoption of digital. The shift from organizational centricity—in which oil and gas companies define what to produce—to individual centricity—where technology-savvy consumers demand customized engagement—requires a fundamental change to marketing, sales, and service. The omnichannel experience needs to be consistent, whether it happens online, through a follow-up phone call, via a local preferred distributor or dealer, or is supported by a trusted business advisor.

New entrants in the oil and gas industry are crossing the entire value chain, from upstream to midstream, and at the distribution and retail consumption level. Many have already digitized. For example, analytics startups like DrillingInfo and OAG Analytics are targeting oil exploration with products that analyze geologic data to choose the best drilling locations and well configurations. Blue Gentoo’s Intelligent Hydrate Platform provides intelligent, real-time management of gas hydrates and enables the digital transformation of the oilfield.

As a result, industry players need to systemically evaluate, build, buy, partner, invest in, or incubate “as-a-service” options to determine their place in the value chain and where to partner. This environment requires organizations to reshape their enterprises and transform the markets in which they compete.

Innovation focus is evident, execution isn’t

Thirty-nine percent of executives surveyed said innovation is important to the success of their organization today. That number more than doubles to 82 percent of respondents when asked to look ahead three years.

The executives surveyed indicate innovation is needed to achieve greater operational efficiency. Over the next three years, their organizations plan to drive innovation to control costs, improve asset productivity, and enhance asset reliability. They expect these efforts to enhance responsiveness and agility. Nearly two-thirds of the oil and gas executives surveyed report their organization’s innovation activities are—at best—on par with other, similar companies or that they are a market follower. Only slightly more than 40 percent of respondents say they are executing an innovation strategy which can improve their effectiveness at creating value.

Innovation effectiveness does not match desire

Meet the authors

Ole Evensen, Leader, IBM Global Chemicals and Petroleum and Industrial Products Center of CompetencySpencer Lin, Global Research Leader, Chemicals, Petroleum, and Industrial Products, IBM Institute for Business Value

David Womack, Global Director of Strategy and Business Development, Chemicals and Petroleum industry

Originally published 30 January 2020