Why CFOs should care about advanced analytics and cognitive computing

Finance analytics is taking off, with over two-thirds of organizations expecting to have substantially implemented analytics across most Finance activities in two years. Thirty-one percent of participating Finance organizations were determined to be “most effective,” having higher analytics maturity. Now, with a powerful analytic foundation, these leaders are starting to find out what they don’t know. It is no longer enough to understand what has happened and apply that to what might happen in the future – market disruption clearly demonstrates the need to identify unknown opportunities and risks. In this report, the experiences of leading Finance teams provide insights into capitalizing on the next wave of analytics: cognitive computing.

Tempestuous times. Disruption of the status quo. Huge turbulence. Industry convergence. New competitors. These trends highlighted in our latest C-suite Study continue to challenge enterprises worldwide.

Who better to help their enterprises manage such challenges than the CFO? After all, CFOs are expected to play an integral role in performance management. Historically, the emphasis has been on leveraging trusted information to understand and communicate the state of the business (hindsight), and helping to anticipate where the business is going (foresight). That’s no longer enough. In light of today’s multi-faceted challenges, CFOs must help uncover hidden opportunities and risks.

Considering that profitable revenue growth is once again a top priority for CFOs, the need to leverage more data, develop more intuitive analytical models and start using cognitive technologies are essential. CFOs can help their enterprises drive agility and growth by doing more to explore the unknown through analytics and cognitive computing. Leveraging already agile organizations, CFOs with top-performing Finance teams are preparing to do just that.

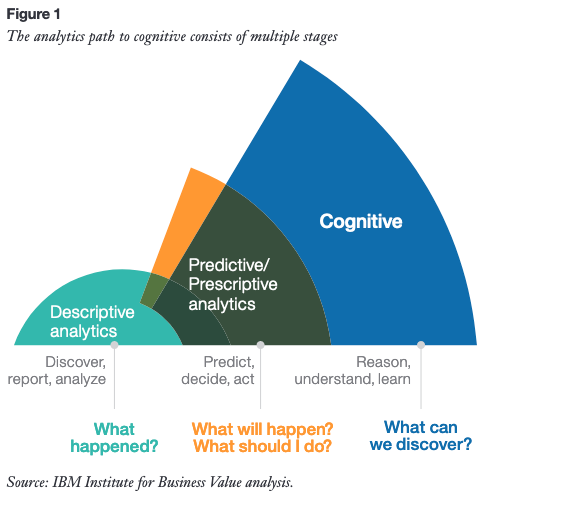

Mature analytic platforms with an added layer of cognitive computing capability can enable CFOs and their Finance organizations to dramatically shape the future (see Figure 1). CFOs have typically used analytics to assess the current state of the business (descriptive analytics).

More recently, significant investments in integrating information across the enterprise and more advanced analytic models (predictive/prescriptive analytics) have enabled significantly better predictive insights and uncovered new revenue pools. Looking forward, the application of cognitive computing capabilities offers opportunities to further improve agility by enhancing both operational processes and growth by uncovering previously unknown opportunities faster.

In 2016, we surveyed 336 senior Finance executives across a variety of geographies, enterprise sizes and industries to look at their usage and adoption of analytics, and plans for implementing cognitive computing technologies. This report explores the CFO perspective on the state of analytics, what leaders are doing differently that drives their success and how cognitive computing is expected to further transform the Finance function.

Meet the authors

William Fuessler, Global Domain Leader for Finance, Risk and FraudCarl Nordman, Director, Global C-suite Study Program, and CFO Research Lead, IBM Institute for Business Value

Spencer Lin, Global Research Leader, Chemicals, Petroleum, and Industrial Products, IBM Institute for Business Value

Download report translations

Originally published 01 November 2016