At the beginning of the year, I was invited by the IBM Institute for Business Value (IBV) to join 44 IBM global experts—members of the Industry Academy and Academy of Technology—to reflect on key trends driving investments and actions in 2021. We identified eight trends that will dominate and push banking and financial markets leaders to take action toward new cloud-based business architectures:

Let’s explore why security and fraud risks continue to rise as financial institutions shift operating models deployed in response to the pandemic.

Are you reacting or responding in this post-pandemic world?

The pandemic outbreak was a moment of reckoning for security and fraud prevention programs in the financial services industry. Although many aspired to embark on a digital transformation journey to unify business processes and customer interactions with intelligent risk operations, only a handful were ready in 2020.

As most economies were forced into lockdown, CEOs had to promptly react to enable employees’ remote work, to customers’ request for virtual support, and respond to rising concerns of business continuity. An unplanned remote workforce implementing weak security frameworks was expected to increase the likelihood of data breaches and incident response times. According to the recent IBM survey “Cost of a Data Breach Report 2020,” having a remote workforce was found to increase the average total cost of a $3.86 million data breach by nearly $137,000, for an adjusted average total cost of $4 million.

The C-suite has been challenged to blur the imaginary lines separating business benefits from security and fraud prevention practices as customers demand 24/7 digital access to banking in the post-pandemic reality. Knowing fraud and security breaches have become a multidimensional problem, what is needed are holistic strategies that combine data across security functions, to predict and respond proactively. The implications of an interconnected environment need to be understood and managed for success by making well-informed risk decisions that drive business performance.

Financial crimes are a high risk/high reward business

Financial institutions today are in a position where they can (and should) look back and reevaluate their risk profiles, specifically around cybersecurity and financial crime programs: fraud, counter fraud, know your customer (KYC), and anti-money laundering. Operational activities that were done in haste may have unknowingly enabled an escalation of risk, resulting in significant financial impact.

Current threats span the customer lifecycle, from application and account opening, to payment transactions and non-monetary account changes, harming both the customer confidence and the bank reputation. These current threats include:

As a hypothetical example, a regional bank with a small online presence allows customers to view account balances, conduct direct deposits, and offers online payment processing. When lockdown restrictions required them to close their doors, several critical functions had to be adjusted, such as identify authentication, onboarding new accounts, and originations for loan applications. However, when customer interactions and operational activities moved to digital, many hastily implemented security processes and controls that could contain easily exploitable vulnerabilities.

- Responding proactively to cyberattacks in expanded operating environments. In our “Cost of a Data Breach Report 2020,” we identified that 70% of business respondents report that remote work became a major security consideration and might increase the time to identify and respond to data breaches. The average time to identify and contain a data breach, or the "breach lifecycle," was already 280 days in 2020.

Speed of containment can significantly impact breach costs, which can linger for years after the incident with significant harm to the firm’s reputation. In an uncertain environment of highly complex threats accompanied by information stovepipes, forward-looking executives are investing in capabilities to efficiently identify, evaluate, and manage cyber and fraud-related risks.

- Unifying business approaches to create value. Efficiencies can be gained in fighting financial crime by sharing data and intelligence, and unifying security operations across financial crimes functions. According to PWC’s Global Economic Crime and Fraud Survey 2020, in the past 24 months, US businesses lost a reported $42 billion, with 13% losing more than $50 million.

These numbers are astounding when you think about the bottom line being impacted, in addition to the billions spent on security and compliance. Cybercrime, economic espionage, and state sponsored activities are proving to be too much for the outdated tactics, techniques, and procedures companies have relied upon previously.

Fighting financial crimes with AI

The onus to spot financial crimes falls on the banking and financial institutions that can face significant fines for failures to detect, report, and pre-empt criminal activities. Existing approaches and systems typically detect suspicious activities that align to predefined rules and controls. For example, they would detect users sending over a certain amount of funds or sending funds with a certain degree of frequency. Unfortunately, traditional transaction screening systems fail to identify how criminals tend to work today. To fly under the radar, financial criminals often launder funds between multiple and seemingly unrelated accounts, often across institutions and geographies.

To combat this trend and tie together suspicious webs and patterns, leading financial services organizations are developing unique AI models that fuse together criminal patterns across institutions. Similar to building a “six degrees of separation” network, these AI models can detect activity that would otherwise go uncovered. As these algorithms are trained on patterns, not data, they allow banks to share insights while avoiding the dissemination of sensitive data outside of their firewalls in the name of detecting suspicious activity—further protecting customer privacy and data.

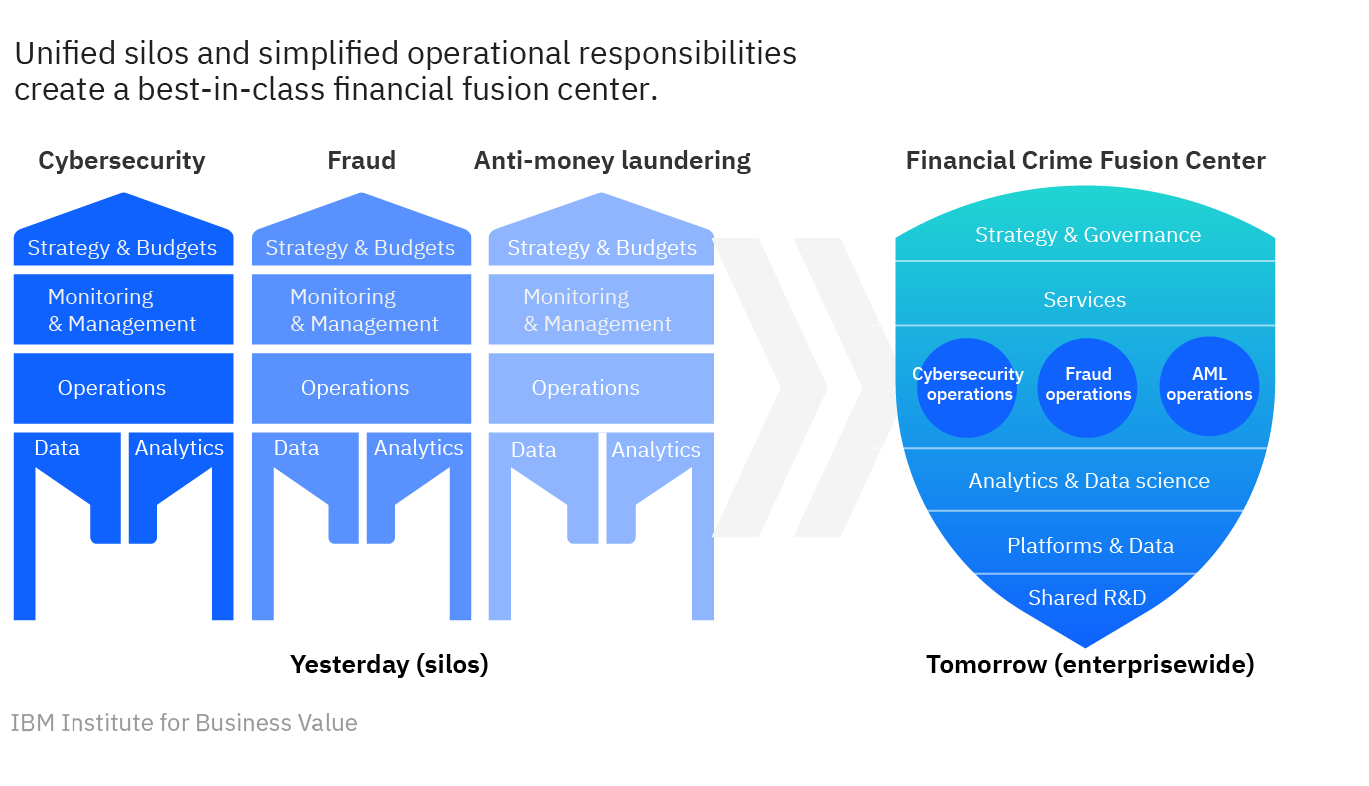

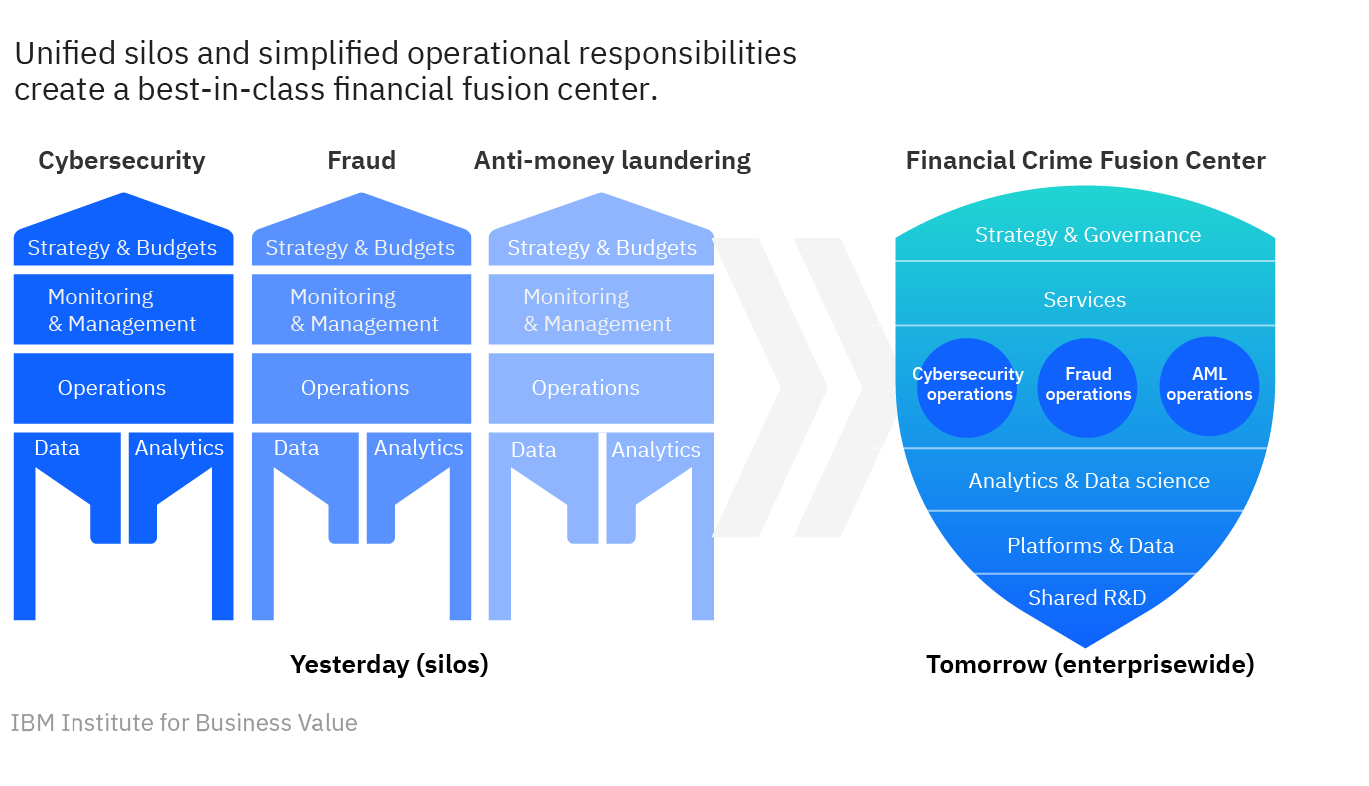

Forward-looking executives who focus their security operations solely on avoiding losses and protecting assets, may fail to see opportunities to achieve business benefits, drive innovation, and mitigate operational resilience challenges. Integrated security and risk management processes unlock business value. Cybersecurity, fraud, and money laundering risk have transcended from capabilities of siloed financial crimes management functions, evolving to a more intelligent risk enterprise.

Connecting the dots

Fraud, anti-money laundering, and cybersecurity programs protect the same customers, but often information is not well connected or shared between each group. While each program analyzes a portion of an incident, they may not see all the relationships between behaviors and interactions, increasing the likelihood that bad behavior goes undetected and the bank’s business is compromised. It is no longer economically viable to defend the enterprise using isolated risk management techniques.

Mobilizing a financial crimes center becomes a unifying force behind a common goal, reducing costs, process redundancies, duplication of activities, and delivering more informed risk management decisions to combat financial crimes.

Targeted financial crimes operating model

Closing viewpoint and recommendations

I recognize this move toward building a holistic security strategy represents a significant challenge as organizations evolve to collaborate, share data, and leverage data sets and technologies. It requires a clear vision, an actionable path forward for joint understanding, and enforcement of an effective financial crimes fusion center. It demands that cohesive processes, people, and technologies are in place for proactive interventions and that well-informed decisions are made by the right people at the right time.

Here are my recommended actions for getting started, and aiming for success:

- A unified mission: A shift in leadership mindset toward a collaborative and community-driven culture will boost innovation and secure client trust to help improve the firm’s competitive advantage.

- A practical approach. Success starts with stakeholder “buy-in” and can be achieved through implementation of a few, simple minimally viable product use cases that can demonstrate immediate value and return on investment (ROI).

Many companies prefer the identification of use cases (Nominal User Behavior by Role, Nominal User Behavior by Session, or Session Trust Score), to guide the overall business architecture, and prioritize initiatives demonstrating immediate value add and operational expense reduction. Recently, one of our European customers was able to drive $21.3 million in loss avoidance and $3.9 million in reduced operating expenses through the implementation of just four use cases.

- A cloud-based integrated platform and business architecture. A strong, open hybrid multicloud foundation leverages systems, tools, and technologies to enable the business of risk management, intelligent risk operations, and data protection across the customer engagement lifecycle.

- Use of “Intelligent” insights. Implement enhanced analytics and well-informed decision making powered by embedded AI models, and leveraging increasingly open and free data.

Financial crimes continue to plague the global economy. In a rapidly changing world, using a cloud-based, integrated platform—unifying operating models and using data to model “intelligent” insights—creates an opportunity to gain competitive advantage. It helps to keep data safe, cybercrime at bay, and makes financial services more accessible to expand operations and improve customer experiences.

To learn more about how AI can help fight financial crimes by analyzing high volumes of risk data, I encourage you to download our recent IBV study, “Artificial intelligence for a smarter kind of cybersecurity.”