The industrial decarbonization dividend in the Middle East and Africa

For industrial giants, decarbonization isn’t a switch to flip—it’s a balancing act between environmental responsibility and economic viability. Deeply entrenched, energy-intensive processes that resist electrification, coupled with capital investments in emerging technologies, create a complex puzzle for leaders in the Middle East and Africa (MEA) navigating the energy transition.

The stakes are high. Globally, industrial companies account for about 30% of total emissions, making them prime targets for regulatory scrutiny, investor demands, and eco-conscious consumers. Indeed, curtailing carbon footprints is a competitive mandate, according to new research from the IBM Institute for Business Value (IBM IBV). In our survey of 181 MEA C-suite executives in the aluminum, cement, chemicals, iron and steel, liquefied natural gas (LNG), and oil and gas refining sectors, 77% say their industry will not remain competitive without large-scale decarbonization.

Inaction is a risk many organizations aren’t willing to take. Our analysis uncovered a group of leading companies in MEA proving the value of bold moves. Through their decarbonization efforts, these top performers tie their decarbonization strategies to a 10% revenue boost, 17% brand reputation improvement, and 21% enhancement in achieving sustainability commitments.

Leading industrial companies in MEA credit a 10% revenue boost to their decarbonization strategies.

In this report, we examine three ways to drive traction with decarbonization.

- In the face of uncertainty, decisive action is key.

Organizations are hedging their bets on a mix of proven and unproven technologies for decarbonization. Rather than focusing on easier solutions to implement, they are investing nearly equal across four pillars of decarbonization strategies: energy efficiency; industrial electrification; low-carbon fuels, feedstock, and energy sources; and carbon capture, utilization, and storage. But 60% of MEA executives acknowledge this approach relies on technologies not yet proven at scale. - Decarbonization must become a company’s operating blueprint.

This is true for our group of leading organizations in MEA. They don’t spend significantly more of their annual revenue on decarbonization than their peers, yet they report greater improvements in renewable energy adoption. Part of their secret? Decarbonization is an identity, not just a strategy. 94% have defined a low-carbon mission that guides day-to-day work. Their commitment extends to talent development as well as ecosystem partner and customer relationships. - Data and AI can turn carbon footprints from muddy to measurable and manageable.

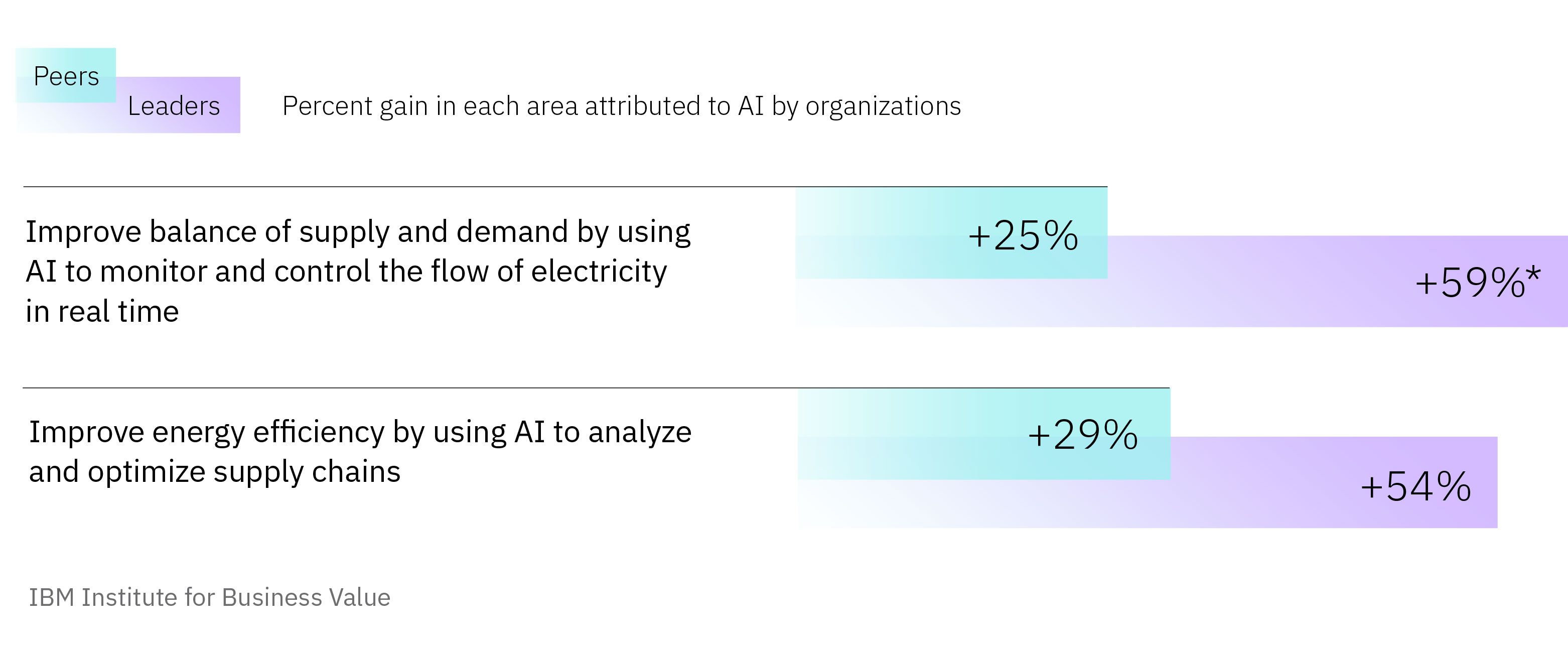

MEA executives say data is the biggest barrier to decarbonization, but leading organizations in the region are using data to fuel AI and advanced analytics as powerful tools to reduce emissions. 91% align their enterprise data strategy with their decarbonization strategy, and 76% say their data and analytics capabilities help reduce energy consumption. This strong data foundation is also paying dividends in their use of and gains from AI. Leaders report twice as much value from AI as their peers.

Leading MEA organizations gain twice as much value from using AI in decarbonization as their peers.

Download the report to learn more. Perspectives offer a deeper look into each sector’s progress and examples of commitment to decarbonization from leading companies in MEA. A concluding action guide suggests steps industrial organizations can take to accelerate their journey toward reduced emissions.

Meet the authors

Zahid Habib, Vice President, Global Industrial Sector Leader, Global Energy and Resources Industry Leader, IBM ConsultingSyed Muhammad Ali Razi, Lead Account Partner, Energy & Resources, IBM Consulting, Saudi Arabia

Mark Hall, Industry Executive, Global Energy and Resources Center of Excellence, IBM Consulting

Spencer Lin, Global Research Leader, Chemicals, Petroleum, and Industrial Products, IBM Institute for Business Value

Originally published 03 November 2025