The cognitive advantage global market report

Cognitive computing is quickly emerging as a transformative technology that enables organizations to gain business advantage. Also referred to as artificial intelligence (AI), cognitive technology augments human expertise to unlock new intelligence from vast quantities of data and to develop deep, predictive insights at scale. This shift to systems that can reason and learn is especially germane to the bottom line; the cognitive era is here in large part because it makes practical business sense.

It’s no surprise then that demand for cognitive computing technologies is skyrocketing. Estimates project the market will grow from $2.5 billion in 2014 to more than $12.5 billion by 2019. Within the next two years alone, half of all consumers are expected to interact with cognitive technology on a regular basis.

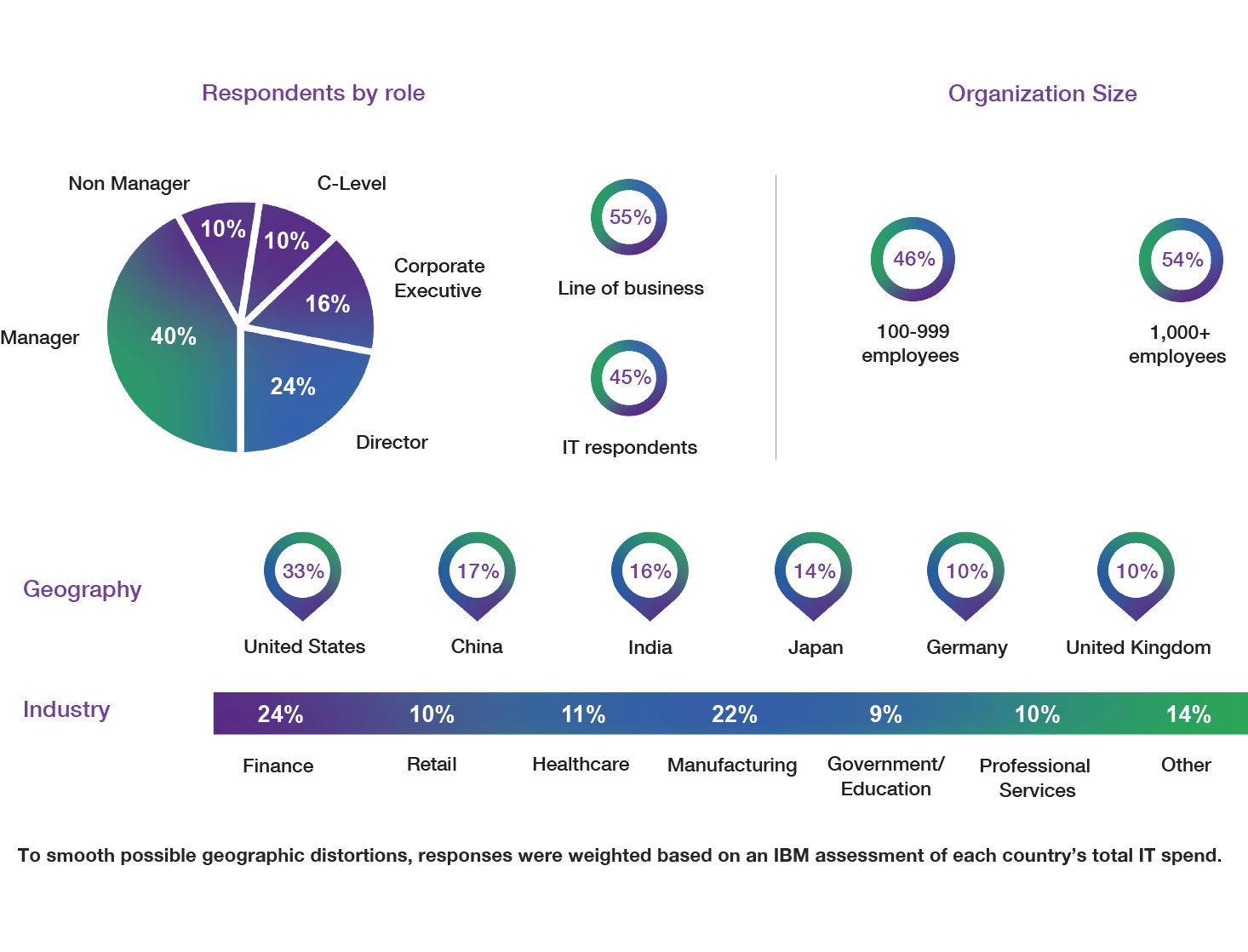

To understand how organizations are capitalizing on the potential of cognitive computing and to uncover emerging patterns of adoption, we surveyed more than 600 decision makers worldwide who are actively engaged in or planning cognitive initiatives. These early adopters fall into three stages of maturity based on their use of cognitive technologies: advanced users (22 percent), beginners (54 percent) and planners (24 percent).

The cognitive early adopters

Advanced users | 22% of respondents

Using 2 or more cognitive technologies for more than a year

Beginners | 54% of respondents

Using cognitive technologies for less than a year or using 1 technology for more than a year

Planners | 24% of respondents

Planning to adopt cognitive technologies within 2 years

Delivering on its promise

Our findings reveal that cognitive computing is proving to be a key differentiator—organizations that already use these capabilities are accelerating business outcomes, from increased customer engagement to improved productivity and efficiency to rapid business growth.

Early adopters see cognitive capabilities playing a critical role in their organization’s growth. Sixty-five percent of early adopters say cognitive technology is very important to their organization’s strategy and success, and 58 percent say it’s an essential element of their organization’s digital transformation. What’s more, those who have already implemented the technology are realizing great value—half have already gained major competitive advantage, and 58 percent believe it will be a “must have" to remain competitive in three to five years.

65%

Of early adopters view cognitive technology as very important to their organization's strategy and success

58%

Of early adopters say cognitive computing is essential to digital transformation

58%

Of early adopters believe cognitive computing will be a "must have" to remain competitive within the next few years

Emerging patterns of adoption

The experiences of early adopters paint a clear picture of success and reveal insights about how cognitive initiatives are approached—particularly, which departments tend to drive initiatives, the types of initiatives employed, and the range of technologies involved. Click the tabs below to explore more.

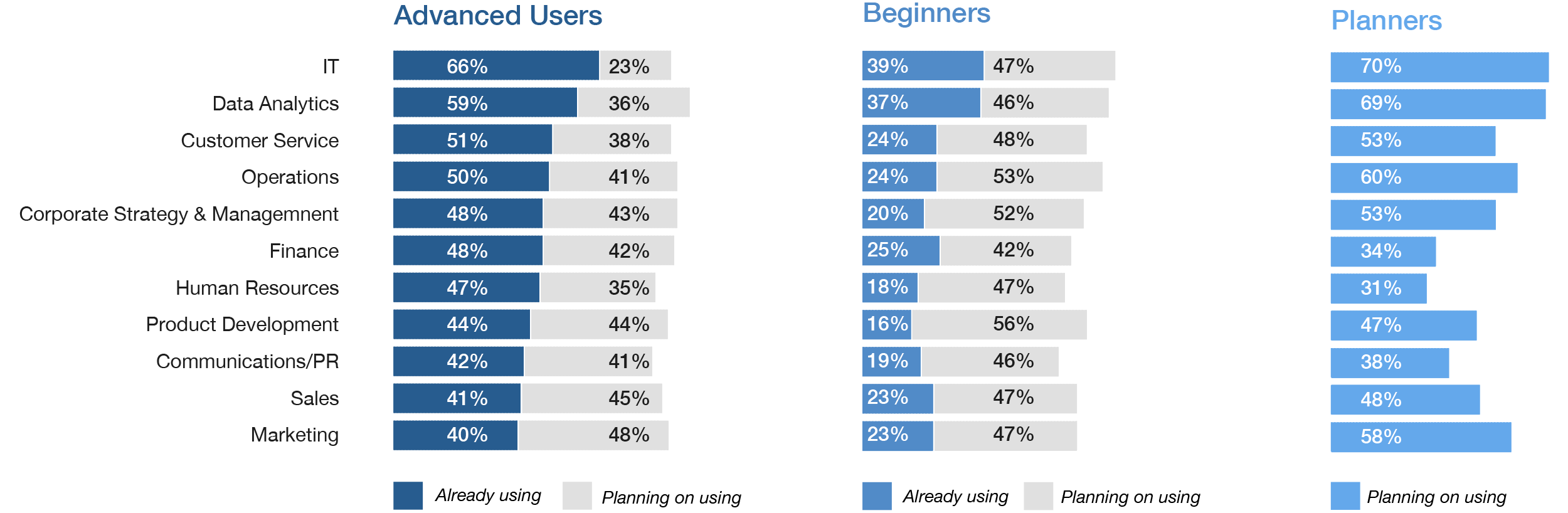

Functional patterns reveal which parts of the organization commonly deploy cognitive initiatives. For all users, Information Technology (IT) is the most common function—66 percent of advanced users spearhead IT-related cognitive initiatives and 70 percent of planners intend to start here. Since IT is typically the test-bed for new solutions and the nervous system for organization-wide initiatives, it is perhaps not surprising that all early adopters look to this conduit to also make cognitive adoption pervasive.

Data Analytics, another key player in organizational cognitive initiatives, is the second most common entry point with 59 percent of advanced users already deploying cognitive projects in this functional area, and 69 percent of planners gearing up for cognitive. As Data Analytics emerges as a formal function within more organizations, and roles like the Chief Data Officer (CDO) become more common to address the influx of organizational data and data-related challenges, Data Analytics, like the IT function, can also serve as a silo breaker, allowing cognitive intelligence to permeate throughout the organization.

Along with Customer Service, planners also cite Marketing and Corporate Strategy and Management as key areas, indicating increased interest and adoption by line of business with an eye toward customer-centric goals.

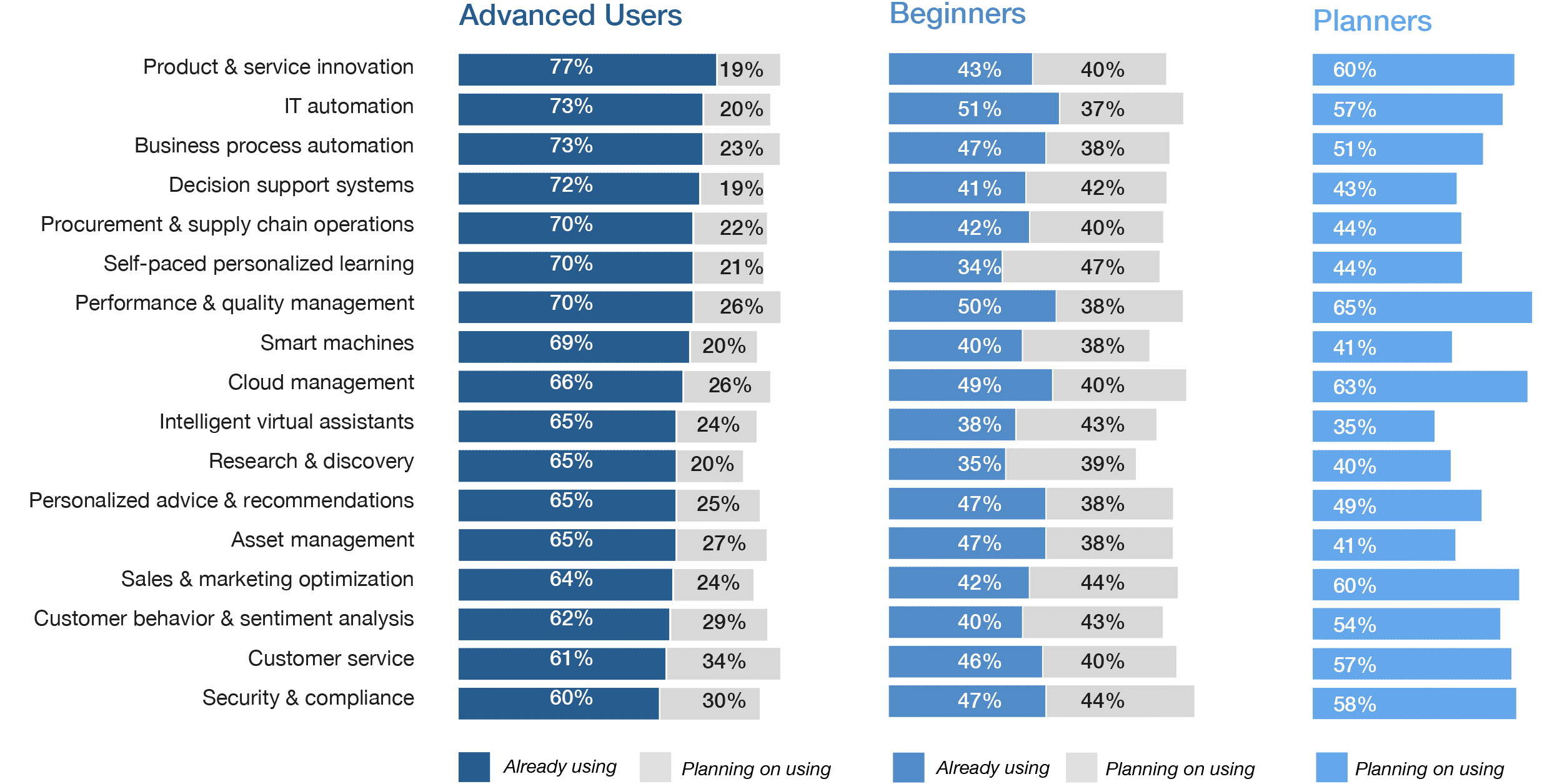

Goal-based patterns reveal why the technology is most often used, with use cases that range from internal organizational processes to customer-focused use cases. The top goal-based pattern is product and service innovation (77 percent of advanced users and 60 percent of planners) where early adopters are using cognitive technology to research, rapidly develop and deploy new offerings, from healthcare to financial services. IT automation (e.g. using cognitive solutions for IT service management) and business process automation (e.g. automated claims processing) round out the top goal-based patterns. These adoption patterns are consistent across all early adopters segments, but planners do indicate more interest in deploying use cases for performance and quality management and cloud management.

While IT-based initiatives surface as common entry points, it’s clear that organizations are looking toward a variety of customer-centric use cases. These range from personalized advice and recommendation systems, which can provide targeted health or financial advice, to sales and marketing optimization, where cognitive technology enhances customer relationship management (CRM) or provides more accurate and targeted.

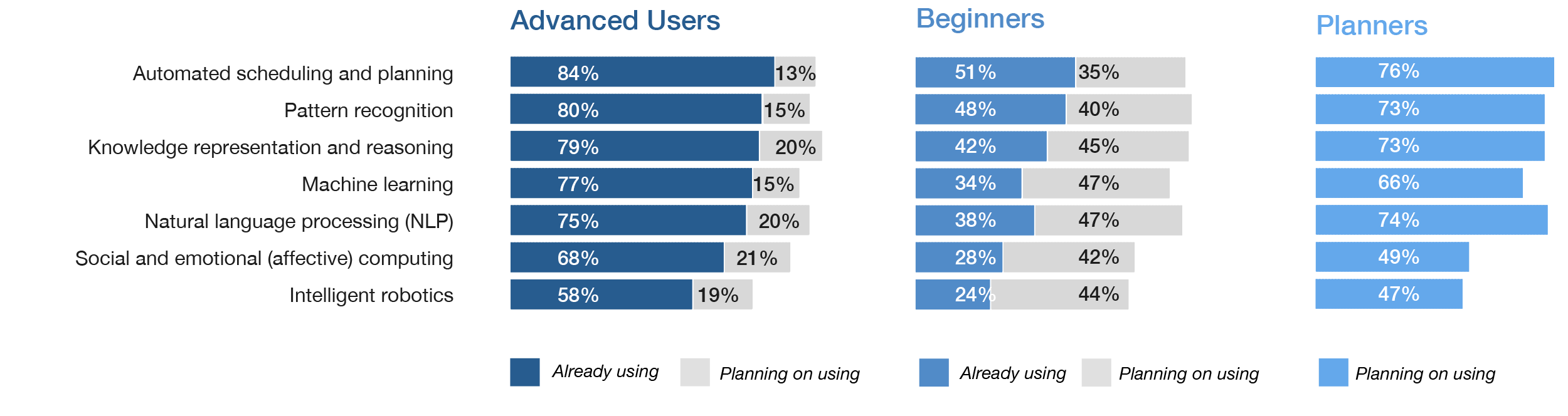

Technology patterns reveal the specific cognitive capabilities most often used in cognitive development and deployment. Across all the maturity bands of early adopters, automated scheduling and planning has the biggest audience. They’re using it, for example, to create plans for execution by intelligent agents in dynamic environments for sophisticated uses like the planning and scheduling software used by Mars Rovers or the Hubble Space Telescope. Eighty-four percent of advanced users already leverage this capability, and 76 percent of planners look toward its potential.

These planning capabilities have historically been an AI mainstay, but they are giving way to new data-centric capabilities. Pattern recognition, natural language processing (NLP) and machine learning (ML) are becoming more commonly used—often in combination—and are considered high priority capabilities for advanced and beginner users and planners alike. Early adopters are also interested in other cognitive technologies such as affective computing (the ability of computers to recognize human emotions and respond in context) and intelligent robots (governing robotic behavior in unforeseeable situations without programmatic guidance).

Benefits are accruing

Users have begun to realize powerful business outcomes from their cognitive initiatives, from enhancing customer relationships to greater efficiency to business growth. Sixty-two percent of users say their cognitive implementations already exceed their expectations. And advanced users who started earlier gain the greatest benefits from cognitive applications; systems that continue to learn and adapt lead to greater outcomes over time.

Almost half of users report improved customer service (for example, better self-service or agents armed with more timely and accurate intelligence) as well as personalized customer experience (for example, through targeted recommendations and offers) as their top outcomes. For advanced users, the gains in customer engagement and the ability to respond faster to market needs were nearly doubled compared to beginners.

Improved productivity and efficiency is just as significant an outcome, and cost remains a key consideration as organizations embark on cognitive initiatives. Users also leverage cognitive technology to improve learning experiences by supporting the development of new educational tools and customized programs for students, employees and customers. Here again, advanced users are twice as likely to achieve these outcomes as their beginner counterparts.

While making strides in customer-centric or operational goals can be transformational on their own, cognitive users have an eye on growth-oriented outcomes such as expanding their ecosystem or growing the business in new markets—outcomes which may take center stage as cognitive adoption matures.

Customer engagement

49%

Improved customer service

49%

Personalized customer /

user experience

43%

Increased customer engagement

42%

Enabled faster response to

customer / market needs

Productivity & efficiency

49%

Improved productivity & efficiency

46%

Improved decision making & planning

46%

Improved security & compliance, reduced risk

45%

Reduced costs

42%

Enhanced the learning experience

Business growth

42%

Expanded ecosystem

41%

Expanded business into new markets

39%

Accelerated innovation of new products / services

Customer engagement

49%

Improved customer service

49%

Personalized customer /

user experience

43%

Increased customer engagement

42%

Enabled faster response to

customer / market needs

Productivity & efficiency

49%

Improved productivity & efficiency

46%

Improved decision making & planning

46%

Improved security & compliance, reduced risk

45%

Reduced costs

42%

Enhanced the learning experience

Business growth

42%

Expanded ecosystem

41%

Expanded business into new markets

39%

Accelerated innovation of new products / services

Benefits are accruing

Users have begun to realize powerful business outcomes from their cognitive initiatives, from enhancing customer relationships to greater efficiency to business growth. Sixty-two percent of users say their cognitive implementations already exceed their expectations. And advanced users who started earlier gain the greatest benefits from cognitive applications; systems that continue to learn and adapt lead to greater outcomes over time.

Almost half of users report improved customer service (for example, better self-service or agents armed with more timely and accurate intelligence) as well as personalized customer experience (for example, through targeted recommendations and offers) as their top outcomes. For advanced users, the gains in customer engagement and the ability to respond faster to market needs were nearly doubled compared to beginners.

Improved productivity and efficiency is just as significant an outcome, and cost remains a key consideration as organizations embark on cognitive initiatives. Users also leverage cognitive technology to improve learning experiences by supporting the development of new educational tools and customized programs for students, employees and customers. Here again, advanced users are twice as likely to achieve these outcomes as their beginner counterparts.

While making strides in customer-centric or operational goals can be transformational on their own, cognitive users have an eye on growth-oriented outcomes such as expanding their ecosystem or growing the business in new markets—outcomes which may take center stage as cognitive adoption matures.

Customer engagement

49%

Improved customer service

49%

Personalized customer /

user experience

43%

Increased customer engagement

42%

Enabled faster response to

customer / market needs

Productivity & efficiency

49%

Improved productivity & efficiency

46%

Improved decision making & planning

46%

Improved security & compliance, reduced risk

45%

Reduced costs

42%

Enhanced the learning experience

Business growth

42%

Expanded ecosystem

41%

Expanded business into new markets

39%

Accelerated innovation of new products / services

Customer engagement

49%

Improved customer service

49%

Personalized customer /

user experience

43%

Increased customer engagement

42%

Enabled faster response to

customer / market needs

Productivity & efficiency

49%

Improved productivity & efficiency

46%

Improved decision making & planning

46%

Improved security & compliance, reduced risk

45%

Reduced costs

42%

Enhanced the learning experience

Business growth

42%

Expanded ecosystem

41%

Expanded business into new markets

39%

Accelerated innovation of new products / services

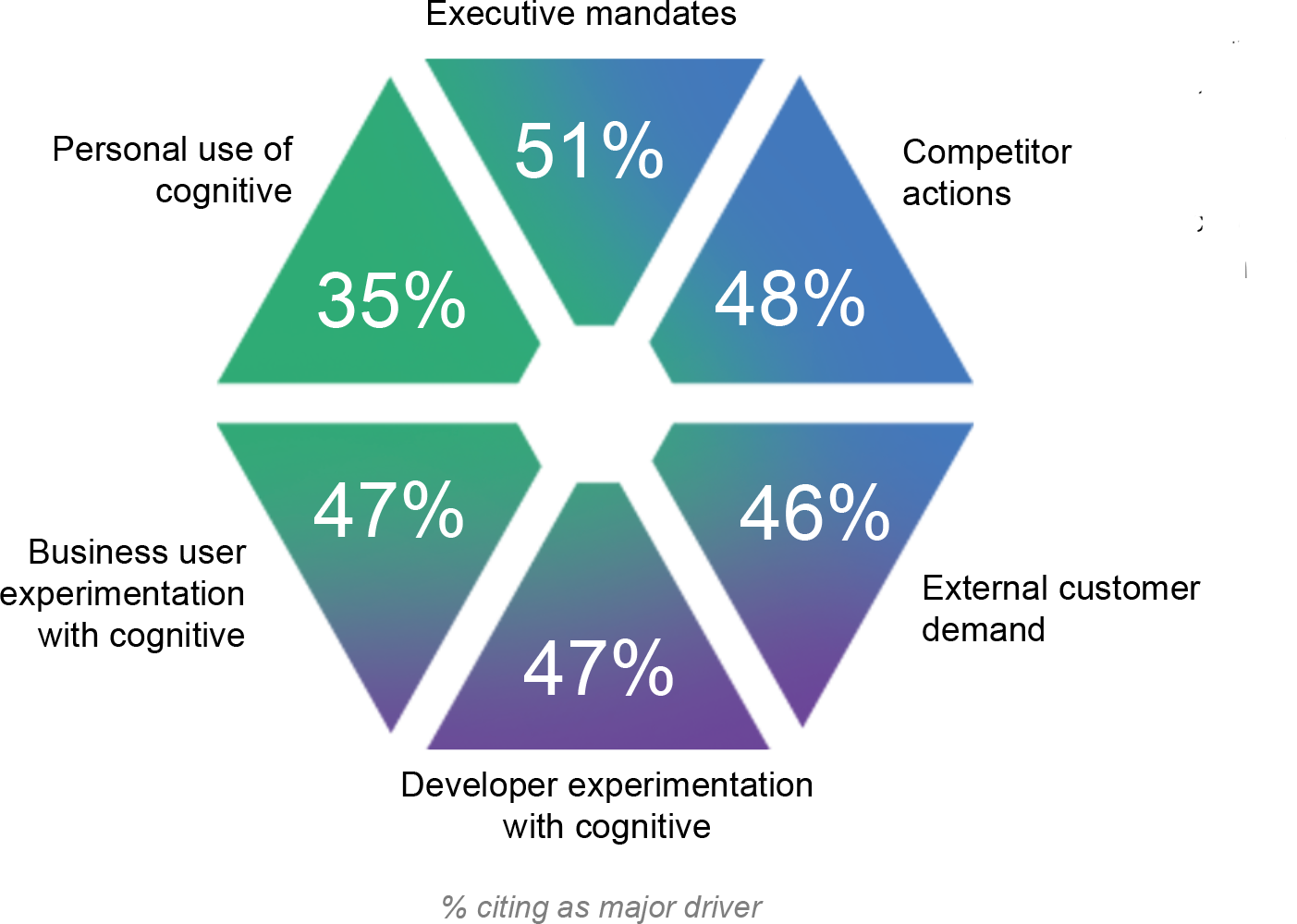

Motivation from all directions

Like many other strategic technologies, cognitive initiatives rely on executive sponsorship—with 51 percent of early adopters reporting that leadership mandates are the catalyst for adoption. But it’s not just a top-down push. Nearly half of early adopters report that bottom-up developer and business experimentation have led to broader and deeper cognitive adoption within their organizations. We expect this trend to continue as the prevalence of APIs and development platforms widens and simplifies access to cognitive capabilities. Reinforcing the view that cognitive is a key differentiator, nearly half also report that competitor actions are driving adoption of cognitive. In addition, the expectations of digitally-savvy customers play a key role.

Of those organizations with an executive-led mandate, IT leaders are the most commonly cited as cognitive owners or influencers, with the Chief Technology Officer (CTO), Chief Information Officer (CIO) and IT managers below the C-level leading the charge.

Yet, most programs tend to be cross-disciplinary rather than siloed within IT. Cognitive decision-makers report strong collaboration between IT and the lines of business, with 45 percent of early adopters stating they bring together both sides for cognitive decision-making. This enhanced collaboration and breaking down of silos is also echoed in diverse functional cognitive initiatives, from IT to Human Resources to Marketing.

Taking challenges in stride

As with any other new technology, challenges do arise on the cognitive journey—46 percent of early adopters struggle with a roadmap for adoption. This is evident in their lack of a strategic approach to cognitive, with only 7 percent reporting they have a comprehensive, company-wide strategy. Still, 41 percent note that they are in the process of developing a broader strategy. Forty percent are taking a more tactical approach based on specific projects.

% citing as major challenge

Undertaking new and transformational initiatives can be costly, a factor many cite as a major challenge. Early adopters also struggle with managing their data—a resource integral to train and run cognitive applications and systems. The volume and quality of data from diverse sources, integrating siloed data, cleansing and curating data for use in cognitive projects are all key considerations.

There is also a prevalent skills gap. While the technology industry overall faces a skills shortage, this is particularly evident for cognitive skills, with 63 percent of early adopters reporting a need for computer scientists—experts in machine learning, natural language processing and other cognitive computing techniques. Early adopters also cite a need for software developers with experience in developing and implementing cognitive applications and systems as well as domain experts—those with expertise and skills to train cognitive systems.

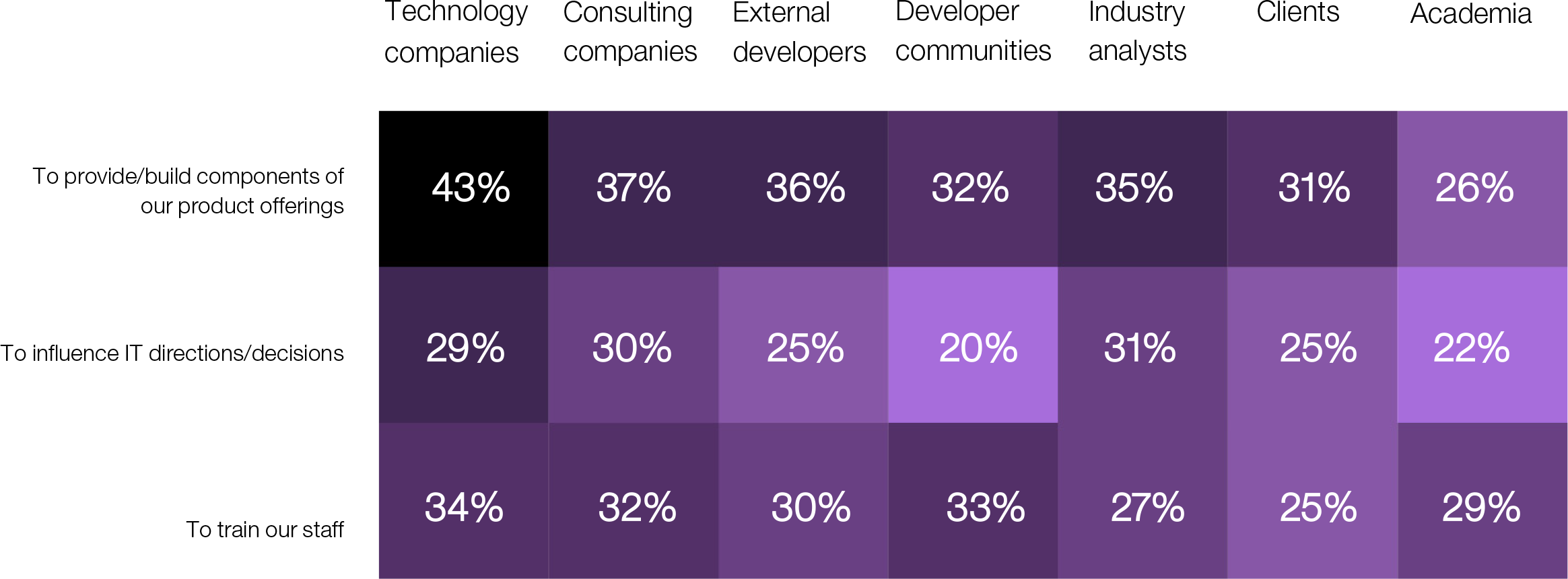

To get around those constraints, early adopters are turning to a broad ecosystem of experts to advise or in some cases supplement much needed skills. While they also look for advice or help with training staff, the biggest need is to help with building or providing product components, with a reliance on technology companies, external developers and consulting companies to provide the most support.

An ecosystem of experts, including IT companies and consultants, helps organizations with cognitive initiatives

% using partner for this activity

Enabling technologies pave the way

To gain cognitive advantage, organizations need a strong digital foundation. Early adopters benefit from taking a holistic view of IT. In fact, 9 out of 10 respondents say cloud computing, data analytics and security will each play an important role in cognitive initiatives within two years. There is also a strong linkage between cognitive and mobile and the Internet of Things (IoT) where applications and devices can benefit from cognitive intelligence.

Cloud remains the platform of choice, with 55 percent of users favoring cloud-based services and another 32 percent reporting that their cognitive initiatives rely on a blend of cloud-based services and non-cloud. Both software-as-a-service (SaaS) and platform-as-a-service (PaaS) top the list for development and deployment. Over time, cognition-as-a-service (CaaS) will emerge as its own class. Open source is also important: over half of users are using open source technologies to support cognitive initiatives. Among developers, 74 percent expect to make heavy use of open source technologies.

Early adopters, especially advanced users, tend to be analytically mature organizations, using not only descriptive (historical view) and predictive analytics (analytical insights to predict possible outcomes), but also more sophisticated prescriptive analytics (intelligence and modeling to recommend next steps or actions) to uncover insights from all types of data. Given that strong analytics base, it’s notable that 60 percent say that cognitive technology is essential to tackling data challenges that are not possible to conduct using conventional analytics, and more than half believe cognitive technology will unlock hidden value from dark data such as voice, images and video.

These figures are especially encouraging. Before the cognitive era, much of unstructured data, which accounts for an estimated 80 percent of all data created, was incoherent to traditional analytics technology, and therefore was not always actionable. Users already leverage a blend of data types with 62 percent of them tapping into unstructured data for cognitive initiatives. Ninety percent of them plan to utilize a combination of internal company data, external data and shared industry data to derive intelligent insights.

9 out

of 10

say cloud computing, data analytics and security will each play an important role in cognitive initiatives within two years

60%

say cognitive computing is essential to tackling data challenges that conventional analytics cannot

From growing pains to growing gains

Cognitive computing's rapid emergence hasn’t been without difficulties, but the experience of early adopters proves that significant benefits can be realized. Lessons from successful adopters highlight these best practices.

Choose your on ramp

Determine a starting point by considering your needs and resources. Target a use case with a strategic goal and data to support it. Will you pursue enterprise-wide transformation, or improve a specific business process?

Advance your data strategy

The success of your cognitive initiative will depend on the volume and quality of data at your disposal. Consider leveraging a diverse range of untapped data sources based on your business need—from structured to unstructured, and from internal to external sources.

Team for success

Encourage your IT and business leaders to collaborate on the organization’s cognitive initiatives. Enlist a team of cognitive, software development and data specialists to implement and manage cognitive pilots and supplement your in-house expertise through your ecosystem of partners.

Want to learn more?