Expanding downstream oil and gas services

The impact of COVID-19 is apparent in the downstream oil and gas industry across oil refining, retail fuel, and finished products. Refining has shifted from a growth orientation to decreased demand, cash preservation, and a reduction in production. Retail stations have seen fewer customers purchasing fuel, thereby reducing inside-the-store sales.

With the average margin on non-fuel sales at or above 30%, higher than the typical 5% to 9% for regular gasoline, their earnings have declined. Finished products demand has plunged with increased telecommuting and production shutdowns, with expectations that global lubricants demand will decline more than 15% in the near term.

52% of downstream oil and gas execs say traditional business models aren’t sustainable in the current market environment.

Even without the pandemic, the downstream oil and gas industry was already challenged—and continues to be—by the rise of alternative fuels, environmental sustainability, shared mobility, advancements in technology, and regulations around data protection and privacy.

Customers are also demanding more from service stations. Visits to the service station are no longer just for fuel, with customers choosing to shop in c-stores for their own convenience. Based on Euromonitor analysis, in 45 of the leading economies of the world, convenience demand is expected to nearly double by 2030, growing at more than 5% per annum.

The most popular new services offerings include retail charging stations, loyalty programs, predictive maintenance, and knowledge-based services.

In this environment, companies must offer and deliver services to respond to disruptive market forces driving industry shifts. With commodity products and limited brand loyalty, downstream oil and gas companies are struggling with how to differentiate their value—whether through cost, features, or quality. Services are also essential to enable refiners to drive high asset utilization.

As a result, downstream oil and gas companies have focused on two critical actions:

1. Driving efficiencies in their refinery and gas processing assets through their service providers

2. In retail and lubricants, shifting from selling products to also offering a broad range of services

Service superstars focus on customer experience and new services

To help organizations improve their service capabilities, we analyzed survey responses and identified a small group of downstream oil and gas “service superstars” consisting of 28% of our survey sample.

These executives reported that their organizations had a well-defined services strategy that their employees understand. Service superstars report that they outperform their peers in innovation, 53% more than their cohorts—which is important in creating new services.

Service superstars have a 13% higher customer satisfaction score—and a 31% lower service delivery cost.

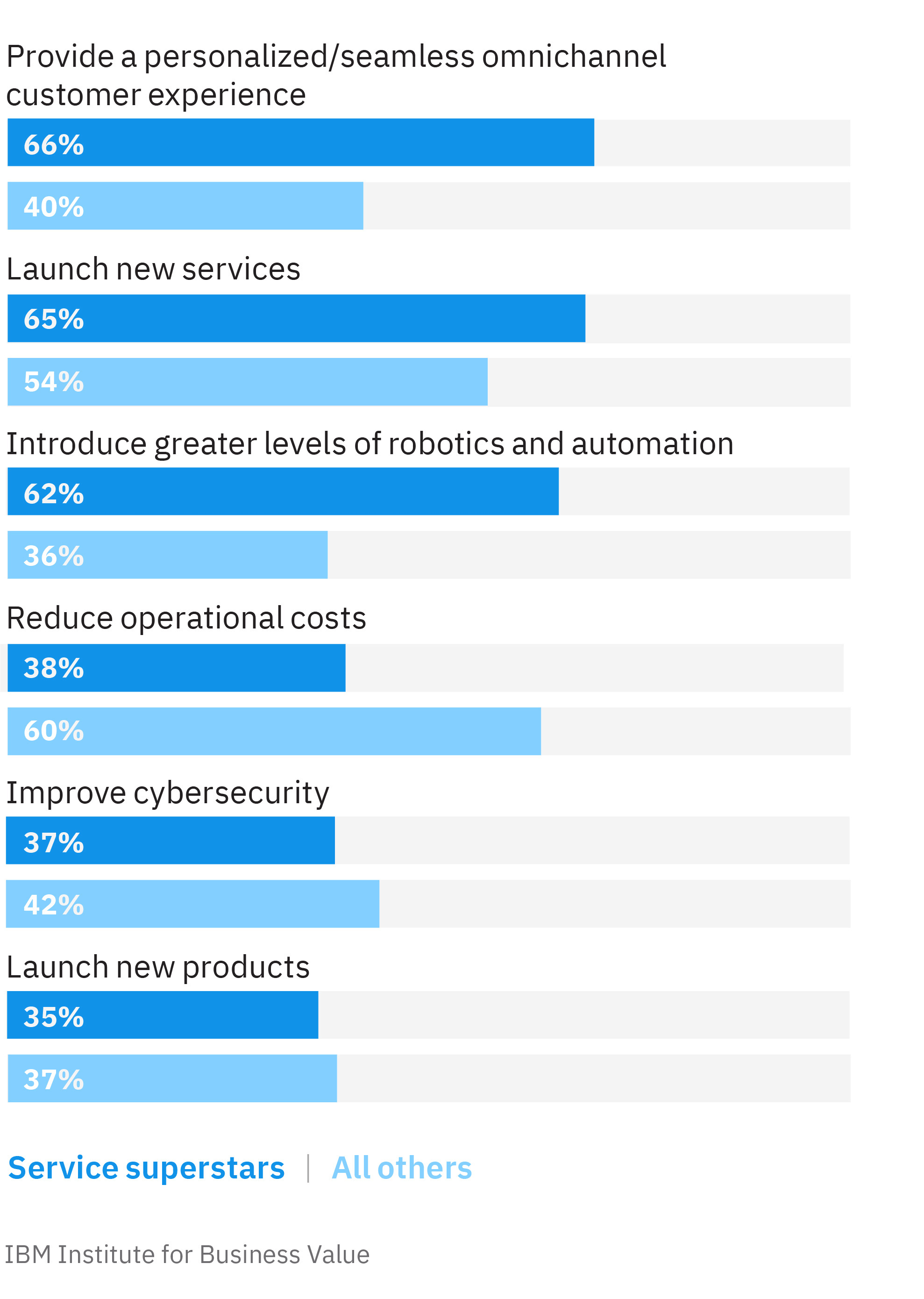

Service superstars are focused on a different set of business objectives compared to their peers. Whereas the peer cohort concentrates on reducing operational costs, the service superstars focus on customer experience and new services. This emphasis is reflected in their performance. Service superstars excel at service customer satisfaction, and their average service delivery cost is over 30% lower. They are also more much effective at launching new services—94% reported they were effective or highly effective versus 75% for all others.

Priorities for a new era: Superstars emphasize customer experience and new services.

Read the full report to learn how innovative services can help your business improve customer satisfaction, create operational efficiencies, and drive revenue growth.

Meet the authors

Hans Bracke, Global Service Transformation Lead for Chemicals, Petroleum, and Industrial Products, IBMSpencer Lin, Global Research Leader, Chemicals, Petroleum, and Industrial Products, IBM Institute for Business Value

Ash Zaheer, Global Chemicals and Petroleum Digital Customer Experience Leader, IBM Global Markets

Originally published 29 June 2021