Our latest Global C-suite Study explores what it takes to lead in a world brimming with bytes. We asked more than 13,000 C-suite officers—including 738 insurance executives—about the value they derive from data, how they intend to turn data into a differentiating advantage, and how far they’ve progressed with their plans.

We identified four distinct stages on the path to data leadership. We’ve grouped the insurance providers in our sample accordingly and named them—in order of progression—Aspirationals, Builders, Explorers, and Torchbearers.

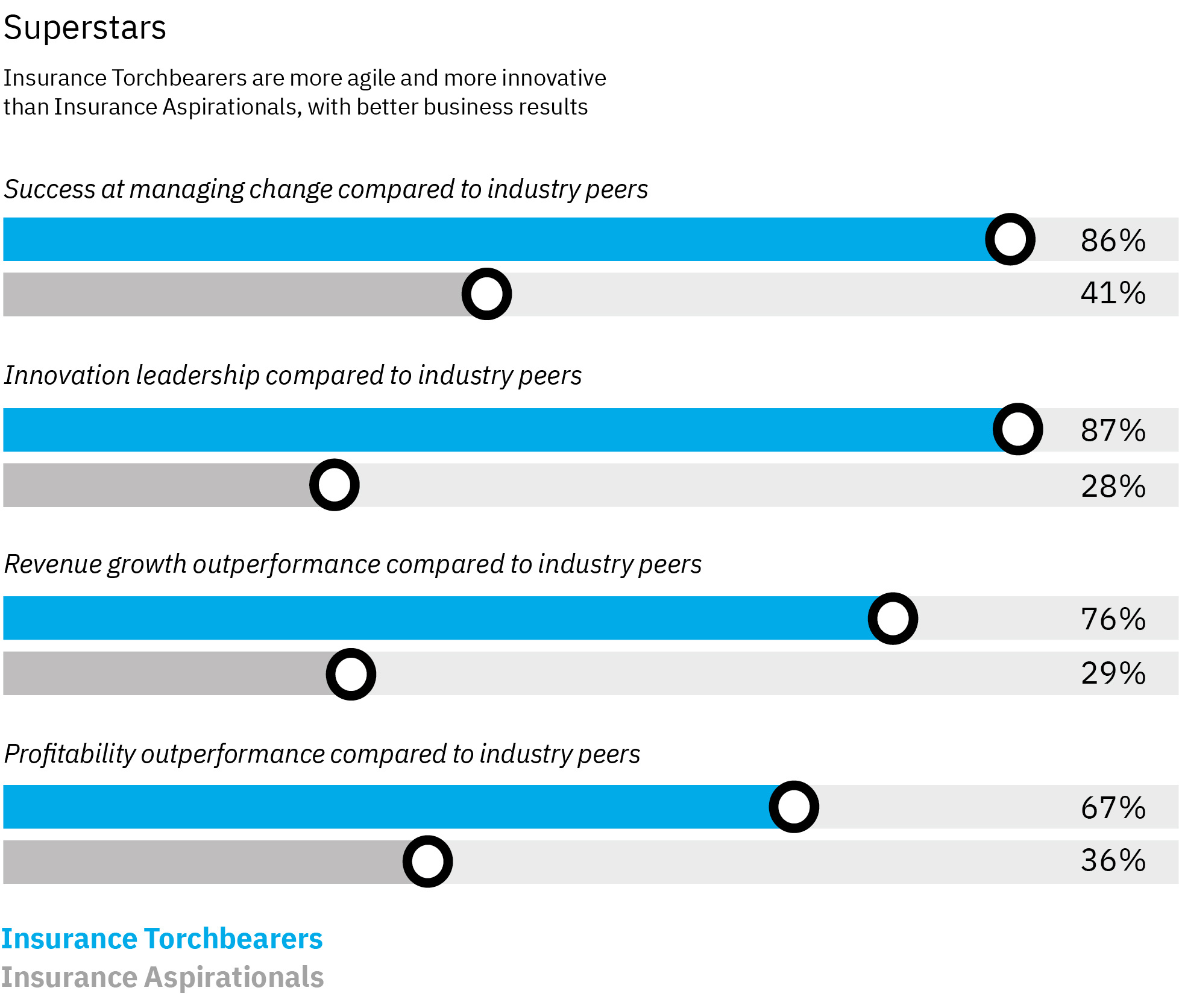

Whichever way you measure them, Insurance Torchbearers stand out from the crowd. Compared to Insurance Aspirationals, they’re much better at managing change and driving innovation. They’ve also generated exceptional revenue growth and delivered outsized profits.

So how are Insurance Torchbearers achieving this stellar performance? Our analysis shows they differ from Insurance Aspirationals in three key respects.

1. Insurance Torchbearers use data to earn customers’ trust

Trust lies at the heart of the insurance industry. When customers buy an insurance policy, they buy a promise that if the event they’ve insured against occurs, the insurance provider will cover the loss. And never has customer trust been so vital, as the COVID-19 pandemic wreaks havoc around the world. With lives and livelihoods alike in jeopardy, people everywhere are anxious.

Data is powering new ways of doing business. It fuels the algorithms that are used to make product recommendations, personalize insurance premiums, and nudge customers’ purchasing choices. It also facilitates the development of new business models. Platforms are a case in point. But accessing the customer data needed to function in this fashion requires that customers trust the insurance provider concerned—and trust is in increasingly short supply.

2. Insurance Torchbearers couple the human with the high tech

Insurance Torchbearers have also created a culture of data believers. A full 78 percent—double the percentage of Insurance Aspirationals—have C-suites that are predisposed to draw on data when making significant decisions.

So what has prevented Insurance Aspirationals from adopting a data-oriented mindset? Functional barriers are one obstacle. Whereas Insurance Torchbearers share data among their business units, the vast majority of Insurance Aspirationals are still struggling to overcome data siloes. Yet data that’s locked up is useless to all but the few people with keys.

Building a culture of data believers isn’t just a question of engaging a company’s leaders and tearing down internal barricades to let data circulate freely. It has to be a bottom-up proposition. That’s why nearly seven in ten Insurance Torchbearers empower employees to delve into data themselves.

The C-suites in these companies take great pains to provide the workforce with the relevant tools and training to analyze data. Virtual cognitive assistants, real-time visualization tools, analytics apps, and other such technologies can all play a part here. But the main goal is to bring the data closer to the people who actually use it.

3. Insurance Torchbearers share data widely, and wisely, in the platform era

Ecosystems are central to many insurers’ plans. In fact, a full 83 percent of Insurance Torchbearers and 68 percent of Insurance Aspirationals envision working with a larger network of partners in the future.

Operating as part of an ecosystem enables insurers to expand their range of offerings and deliver richer customer experiences, which typically results in greater customer loyalty. It may also give them access to new customer data without having to collect the data themselves, although customers must give permission for their data to be shared with third parties.

But the flow of information has to go both ways. Networks can only function effectively if the members share considerable amounts of internal data with each other. More than half of all Insurance Torchbearers have grasped the implications and already share data extensively with their partners, whereas less than a third of Insurance Aspirationals are ready to “open their books.”

That said, not all data should be shared. It’s essential for all insurance companies to provide definitive guidance on when and how data can be shared, with whom it can be shared, and when it must be safeguarded.

What’s next? Our report contains three action guides—one for each area above—outlining steps toward emulating our Torchbearers. Once you evolve into an imaginative, pioneering insurer, the possibilities can be virtually endless.

Meet the authors

Christian Bieck, Europe Leader & Global Research Leader, Insurance, IBM Institute for Business ValueDon Hummer Jr., IBM Partner, Industry Academy Member, Insurance

Fuad Butt, IBM Associate Partner, Cognitive Process Re-engineering, Insurance

Originally published 04 June 2020