As alternative payment options such as PayPal and Google Wallet gain popularity, they also are climbing the list of the C-suite executives' top concerns.

The IBM Institute for Business Value (IBV) has tracked global industry trends through its ongoing series of C-suite studies since 2003. Our latest research, which we will publish in 2018, shows that alternative payment options are starting to influence how business leaders across multiple industries think about their enterprise strategy.

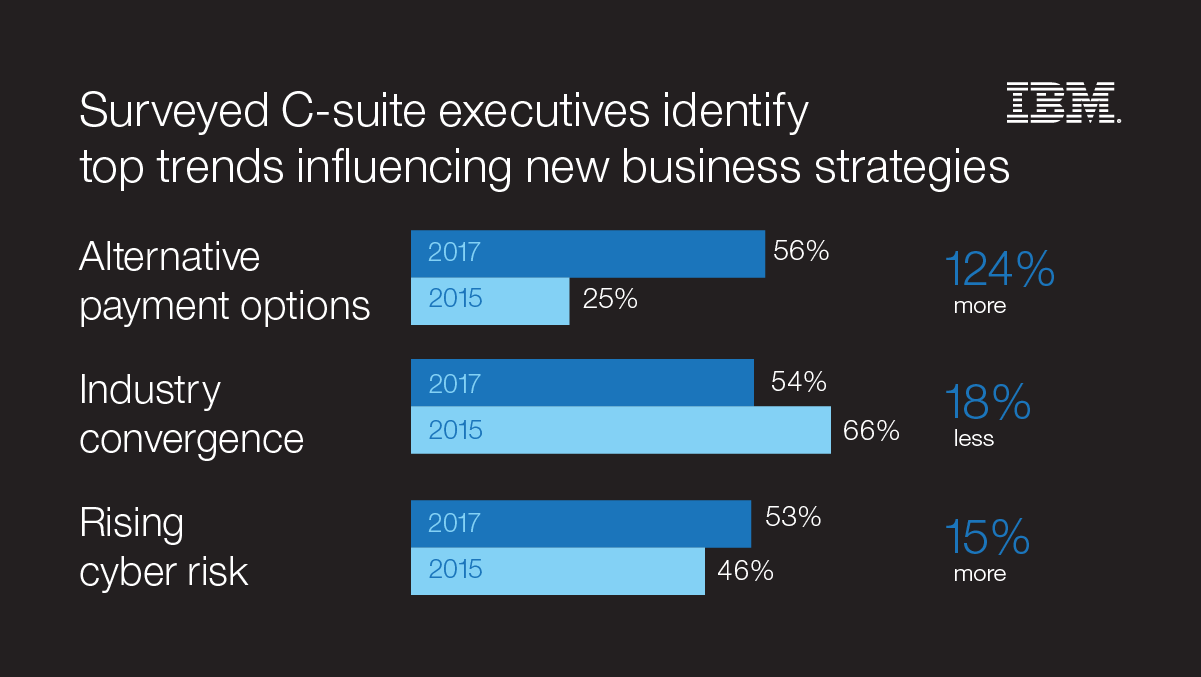

Of nearly 5,000 executives interviewed to date, 56 percent anticipate that alternative payment options will be one of the top three trends that will drive them to re-evaluate their business strategy. That rapid rise to the top of our rankings is startling. In the 2015 Global C-suite Study, only one-quarter of surveyed business executives identified alternative payment services as a potential game-changer. Instead, industry convergence was the trend that kept most executives awake at night.

The rapid ascent of alternative payment options reflects increasing consumer demand for greater flexibility, coupled with speedy growth in the range of products and alternative payment solutions — a perfect match between demand and supply. These new services cover a broad range of digital payment solutions, from barter-based trade exchanges to virtual currencies (or “cryptocurrencies”) such as Bitcoin. The World Bank estimates that 59 percent of the global population will own mobile devices by 2020, so the growth of mobile-based e-commerce will continue to change the ways in which consumers are able to make payments.

Alternative payment options bring an array of potential benefits that are hard for companies to ignore. They can reduce transaction costs while increasing transaction speed. They also can enable greater transparency, fraud protection and access to new markets. Perhaps most importantly, they can foster a simple and seamless experience for customers. Individual customer experience can be tailored and enhanced using data collected from digital transactions through the payment platform.

Another major advantage alternative payment services offer is their settling mechanism. Non-traditional payment systems enable cross-border transactions, allowing businesses to reach international markets with greater ease and relatively minimal investment. This has allowed alternative payment service providers to expand their customer base into more remote areas that lack traditional banking and credit facilities — a market estimated to be as large as two billion adults worldwide.

With the growth in online retail markets, smartphone usage and global internet access, we anticipate digital payment services will continue to grow. Throughout the year, we will monitor how C-suite executives are including alternative payment options in their business strategies. Stay tuned for our next monthly insight as we explore further into the minds of business leaders.

This blog is part of a series of monthly insights that highlight preliminary findings and emerging trends from our 19th Global C-suite Study. The study is based on interviews with more than 10,000 CxOs.