What if you could discover deeper insights buried inside your business documents with less effort in a fraction of the time?

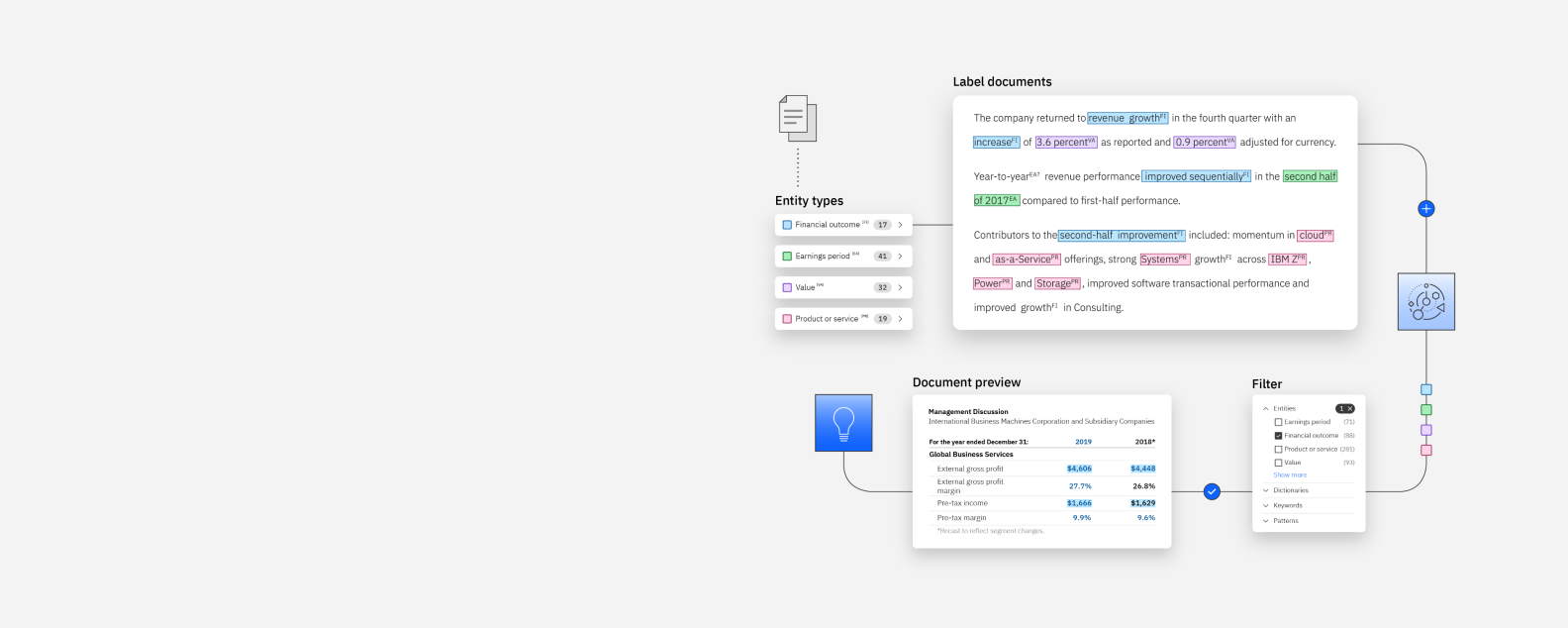

With IBM Watson® Discovery, you can boost the productivity of knowledge workers by automating the discovery of information and insights with advanced Natural Language Processing and Understanding. That means faster business results, satisfied customers and happier employees.

We deliver truly enterprise-grade, trusted, scalable and easy-to-use Natural Language AI, powered by custom NLP models and Large Language Models (LLMs) from IBM Research.

Watson Discovery was named a Leader in the 2022 Gartner® Magic Quadrant™ for Insights Engines.

Multiply the power of AI for your enterprise with IBM's next-generation AI and data platform

An insurance client reduced the time spent reading and analyzing text data by 90%.

A law firm gained 4X better productivity and earned 30% more revenue.

An oil and gas company reached over USD 10 million in savings.

Using natural language processing (NLP), IBM Watson® Discovery helps your underwriters, claims processors, customer service agents, and actuaries find answers and insights from insurance documents, customer data and public data faster. That means faster business results, satisfied customers and happier employees.

IBM Watson® Discovery uses natural language processing (NLP) to help your controls analysts, stockbrokers and wealth management professionals automate searches through volumes of documents and public data. They generate meaningful insights. You get relevant answers faster for better business decisions.

IBM Watson® Discovery uses natural language processing (NLP) to help your attorneys and controls specialists automate searches of large volumes of documents and public data. These insights can help grow revenue and improve client services.

A 2022 Forrester Consulting Total Economic Impact™ study of IBM NLP Solutions, commissioned by IBM, finds IBM Watson NLP delivers a 383% ROI over three years.

IBM Watson Discovery named a Leader in the 2022 Forrester Wave™: Document-Oriented Text Analytics Platforms

Learn how you can accelerate decisions and business processes with Watson Discovery.

For builders of virtual assistants, enterprise search and text analytics solutions.

Get started with IBM Watson in a few simple steps.

IBM Watson Discovery incorporates innovation from the IBM Research labs.

Address customer requests across channels like digital and voice channels. Guide employees through internal processes, allowing your teams to focus on higher-value work—all while reducing costs.

Analyze text to extract metadata from content such as concepts, entities, keywords, categories, sentiment, emotion and semantic roles.

Transcribe your audio with near real-time dictation or batch audio files using our available API that provides out-of-the-box language models, audio frequency options and transcription output features.